From risk aversion to confidence

LLORENTE & CUENCA hereby publishes a new edition of one of its longest-running studies: the M&A Monitor, an analysis of the role of communication in mergers and acquisitions in Spain and Portugal over the period 2014-2017. In this edition we have changed the boundaries and scope of the analysis, in particular to use data obtained since 2014 to anticipate what is likely to be a profound paradigm shift in defining the role communication in these transactions.

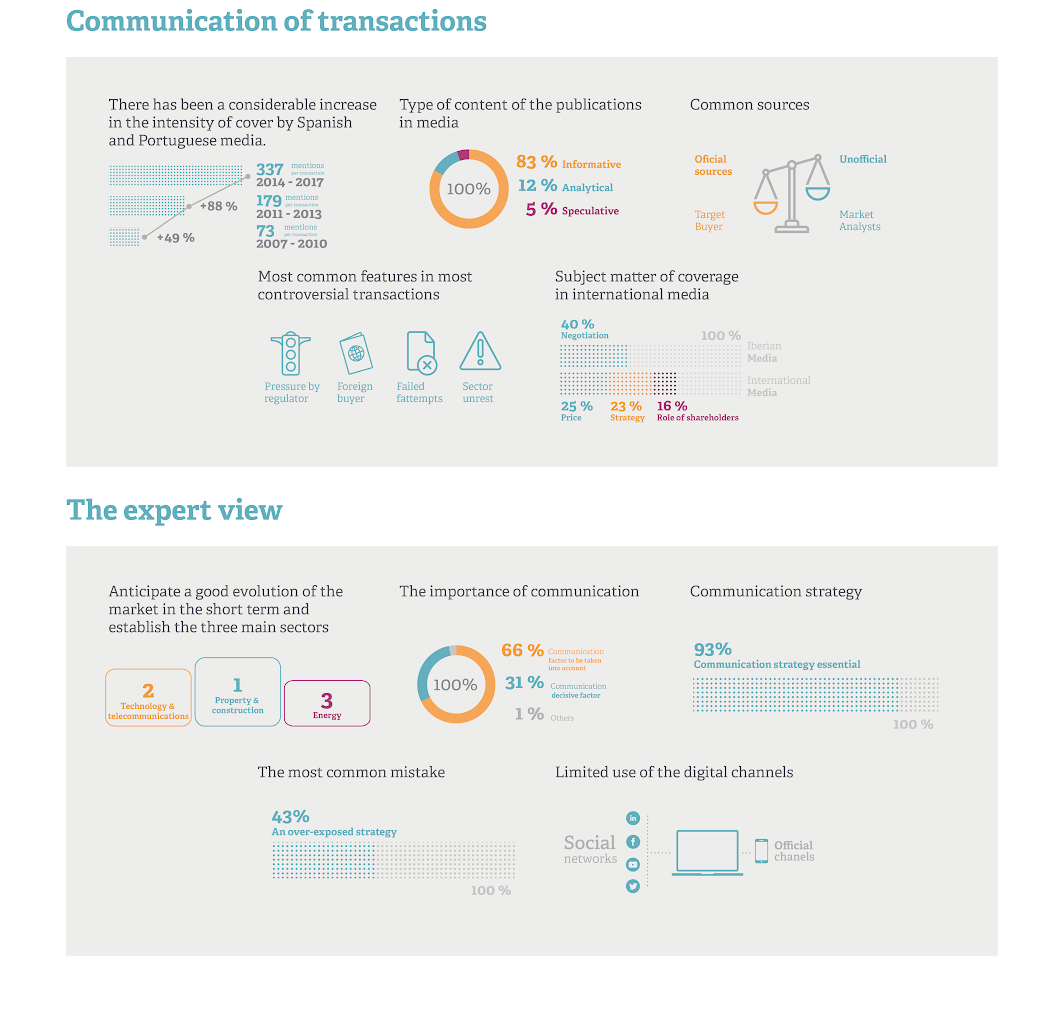

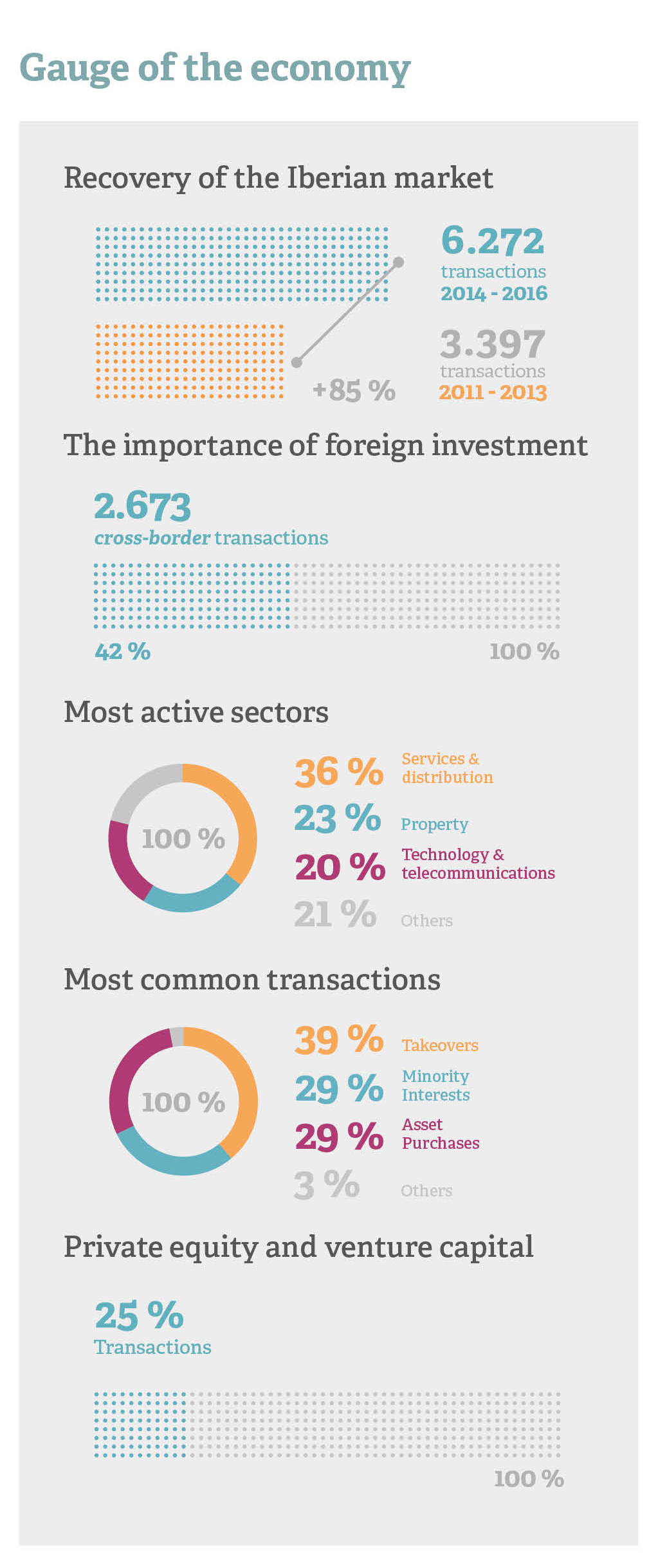

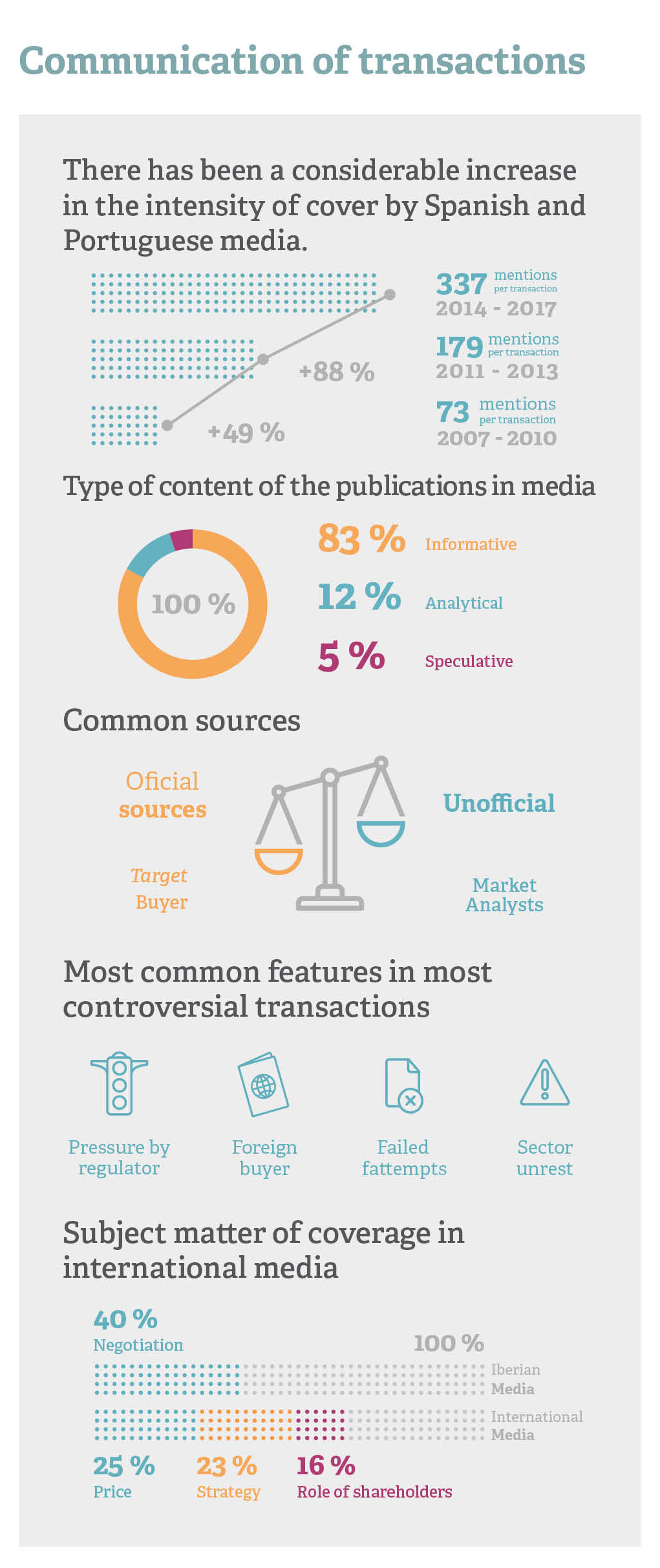

M&A deals intensified between 2014 and 2016, in parallel with the economic recovery. There were 85% more such transactions than in the previous three-year period, though few major developments in terms of communication. Companies appeared to think that it best to avoid mentioning the price, provided there was no obligation to disclose it, and limit media exposure to the legal requirements in each case.

However, things changed substantially in 2017 and in analyzing this situation, we can see that they are going to change a lot more and much faster in the coming months.

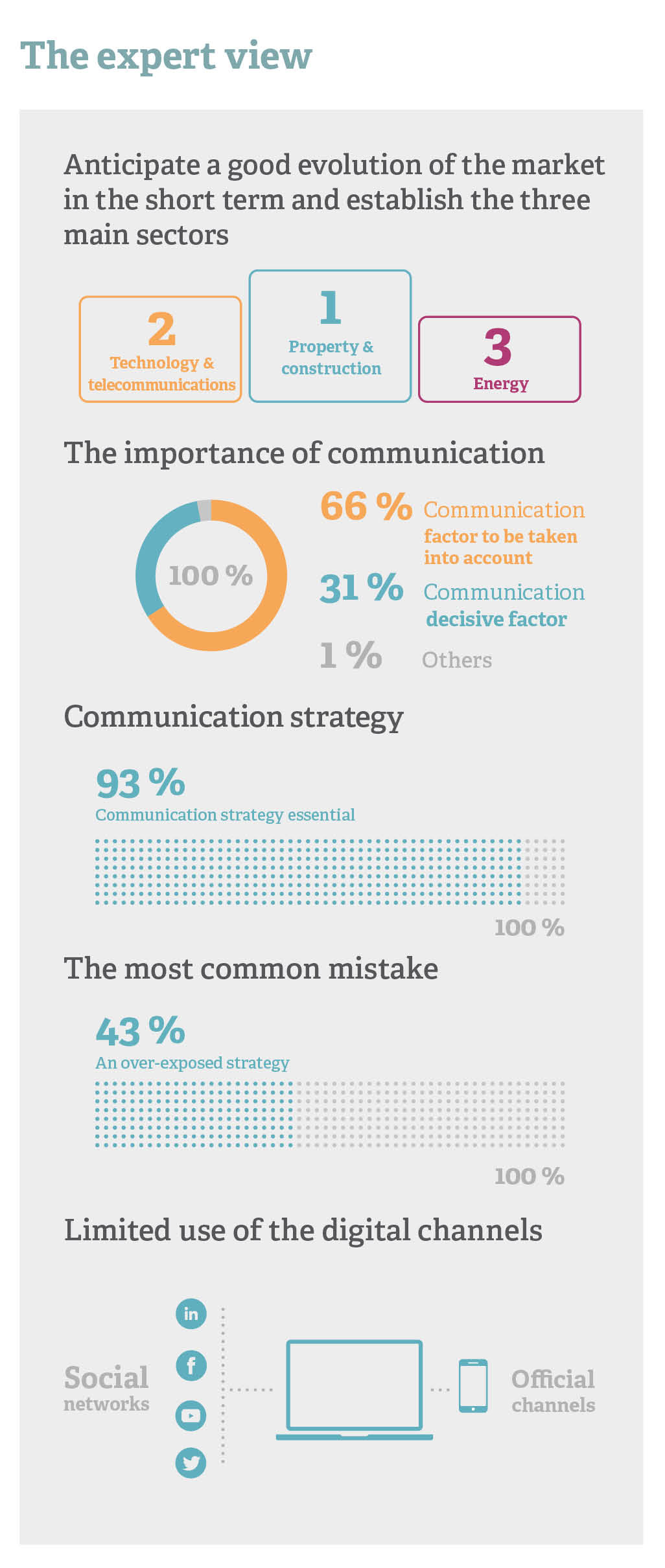

To begin with, according to TTR data, the volume of M&A transactions announced just in the first half of 2017 exceeded all those made in 2016. However, the main change was not quantitative. Against a backdrop of ferocious competition, it is no longer sufficient for each company make a virtue of necessity and only provide the information required by the regulators or the authorities. The different stakeholders, and society as a whole, will also want to know the rationale behind the transaction, the arguments for and against, the sense, the commitment involved in each stage and numerous other details.

This study has helped us define eight essential factors for successful communication of an M&A transaction: negotiation, rationale, price and valuation, growth capacity, reaction by authorities and regulators, team, economic situation of the seller and the social and employment impact. In most cases, a full and timely analysis of these eight parameters would be of invaluable assistance in preparing an efficient communication strategy.

We are convinced that a well-designed communication strategy is crucial to achieve the desired outcome in M&A, undoubtedly inevitable in this era of globalization, with countless sources of information. Clearly, not all strategies are appropriate for all situations, but in any event it will still be necessary to define the communication strategy, be it low-profile, proactive or a combination of the two.

In our opinion, this study confirms that much has to be done for communications to offer tools that will enable an increasingly efficient management of these transactions. Most of the transactions that have been most successful, overall, have also been exemplary in terms of communication. And, as you know, there are no coincidences in M&A.

Authors

Tiago Vidal