When a company goes public, its organization changes forever. It requires not only changes in its relations with investors, but also with each one of its stakeholders. When it comes down to it, becoming a listed company involves greater efforts with regard to transparency, not only with the market, but also with its employees, suppliers and clients. In fact, the regulator itself obliges listed companies to fulfill certain minimum reporting and communication requirements.

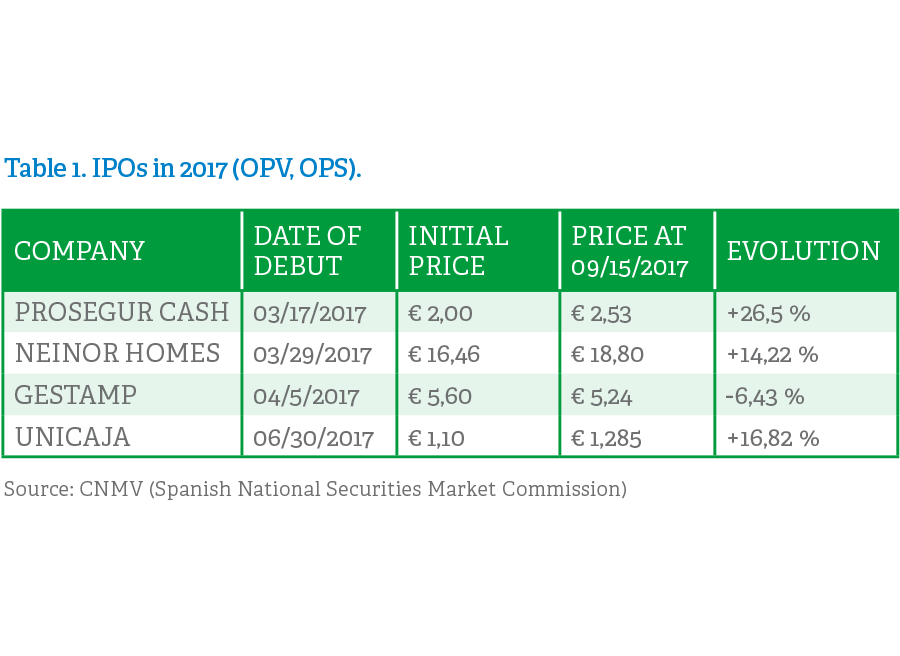

This report analyses how the companies cited below developed their communication strategies during an initial listing process. We have looked at the four initial public offerings and one cancelled operation in the first nine months of 2017.

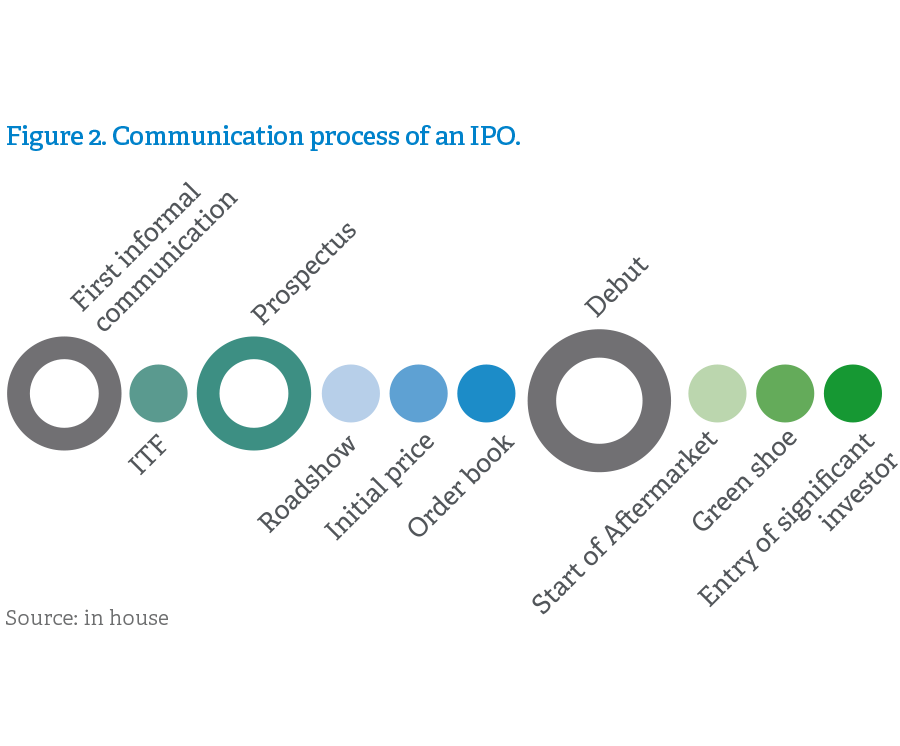

From a communication point of view, in any initial public offering a series of key milestones are identified, which are almost omnipresent, which go hand in hand with those stipulated by the regulator. All of them are liable to arouse interest among the company’s different stakeholders. And it is in this context that a company which is starting to prepare its initial public offering, aware of the reach of the media’s impact on the investment community, should frame its interactions with journalists.

But not only the regulatory milestones arouse the interest of the press… What are the factors which determine how attractive the communication of an IPO is to the media? Can public opinion be shaped in such a way as to facilitate the operation? At what times during the process is attention focused? Is it possible to avoid media speculation or rumors around the IPO? We will try to answer all of these questions in this report, as well as passing on the advice which journalists themselves have conveyed to us.

ANALYSIS OF THE COMMUNICATION OF IPOS BETWEEN JANUARY AND SEPTEMBER 2017

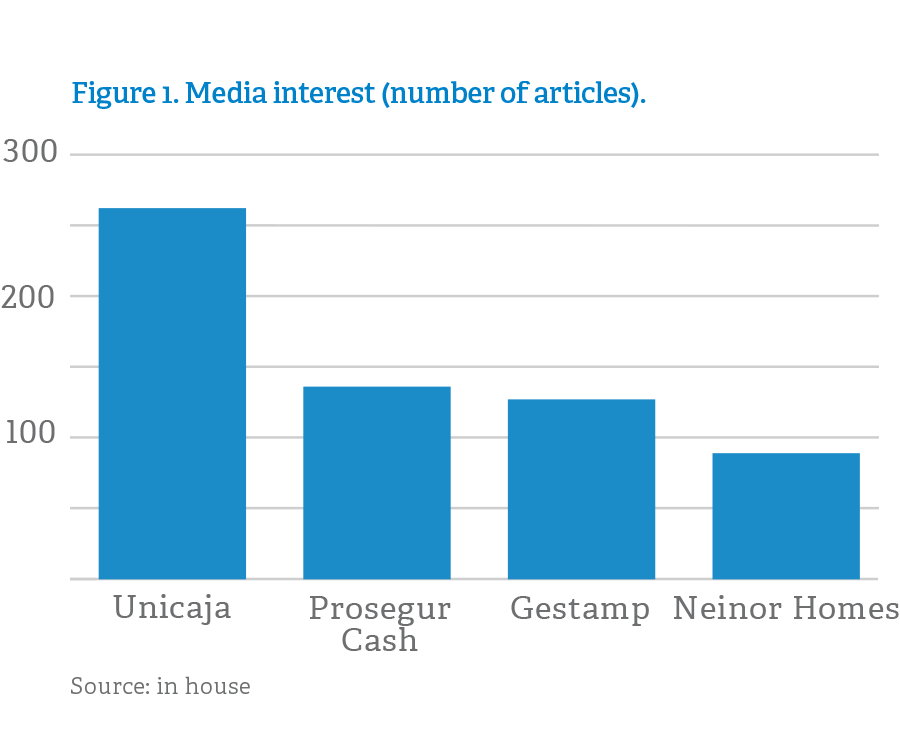

In order to study the communication of the IPOs which took place in Spain in the first nine months of 2017, we have analyzed the main news articles generated in the Spanish media, 649 to be precise. We used different points of view, such as media interest itself, the tone of the publications, the themes present, how proactive the companies were, the type of content or the most significant milestones.

Of the five IPOs, the one which generated the greatest interest, by a considerable margin, was that of Unicaja, with 262 published items recorded, as well as many references in a wide range of articles. That number was virtually twice as many as those of any other IPO, while the failed attempt by Lecta aroused even less interest. Without doubt, the great media interest in the IPO of Unicaja was not due solely to its dimension. The fact that it coincided with the crisis of Banco Popular, the action of the CNMV (Spanish National Securities Market Commission) in response to bearish positions in Liberbank, and the extreme volatility of the market meant that this stock market operation was in the limelight in Spain and even to an extent in the international market.

WHAT, THEREFORE, ARE THE FACTORS WHICH DETERMINE MEDIA INTEREST IN AN IPO?

They are many and very diverse. Even more worrying, many of them are unrelated to the company’s willingness to communicate. Unicaja had to carry out intensive, proactive communication work, maintaining constant interaction with journalists, thanks to which it managed to ensure that the perception of it among public and investors was unaffected by the image of other banking entities, which suffered periods of instability.

CAN PUBLIC OPINION BE SHAPED IN SUCH A WAY AS TO FACILITATE THE OPERATION?

It can, in our opinion. Obviously, it is impossible to build castles in the air, and solid business foundations are required.

When an IPO includes a retail tranche for private investors, though that option is increasingly rare, the influence of the media on public opinion becomes even more important. In this case, the media become the main channel between the company and this type of investor. On the other hand, for IPOs aimed at institutional investors, the international media can become a strategic channel to lend support for meetings with foreign investors.

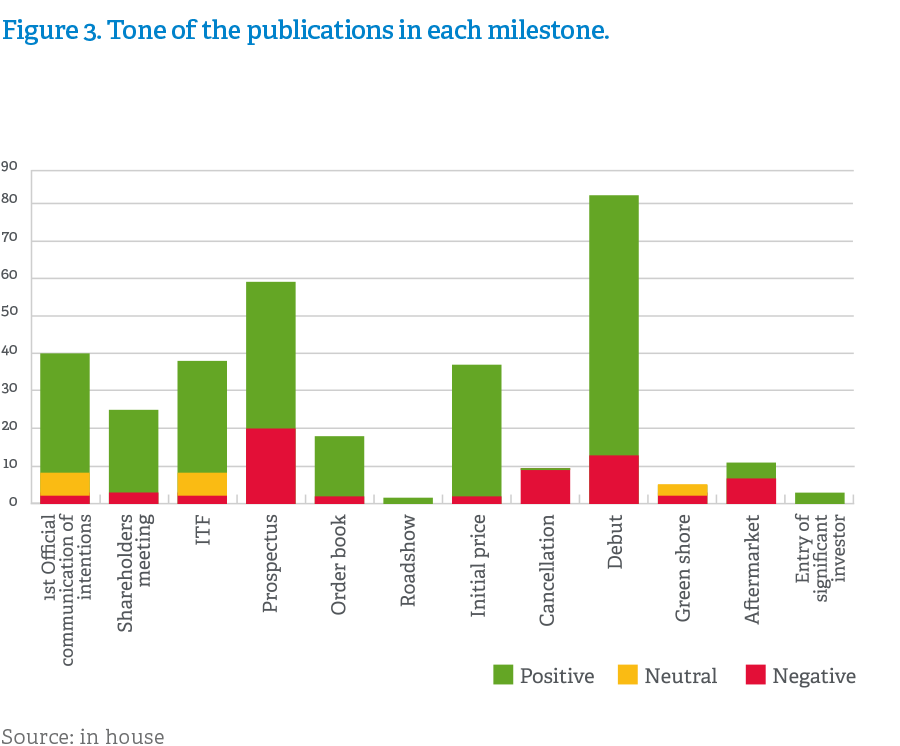

Not all the articles published in the media are directly related to the regulatory milestones themselves. In fact, those milestones account for only about half of the total number of published items. The remaining coverage was generated during the period between one milestone and the next. The most common are rumors and speculation about investor appetite, the range of the offer and the issues which that affect the company from the past, either previously known or which first came to light when the CNMV published the prospectus of the operation.

“Even more worrying, many of them are unrelated to the company’s willingness to communicate “

Based on these data, we believe it is advisable to openly consider the possibility of establishing a planned, proactive and balanced model of communication with the press. As we will see in the next section, journalists are the staunchest defenders of this model, but we will also see that a strict quantitative and qualitative analysis of news articles indicates that they are probably right in this regard.

If we restrict ourselves to the obligatory communication to the market, they coincide with a series of milestones which all IPOs must achieve. That is why a synchronicity is created between those obligatory steps in the IPO and its communication.

Without a doubt, the trading debut is the event which aroused the greatest interest in the operations analyzed. Just two days, the first day of trading and the day after, accounted for 13% of the total number of news articles. After some months of intense management under a blanket of confidentiality and privacy (retrospection, roadshows and negotiations), the ringing of the bell marking the start of share trading shatters that dynamic and places the company in the most public, visible spotlight of the entire process.

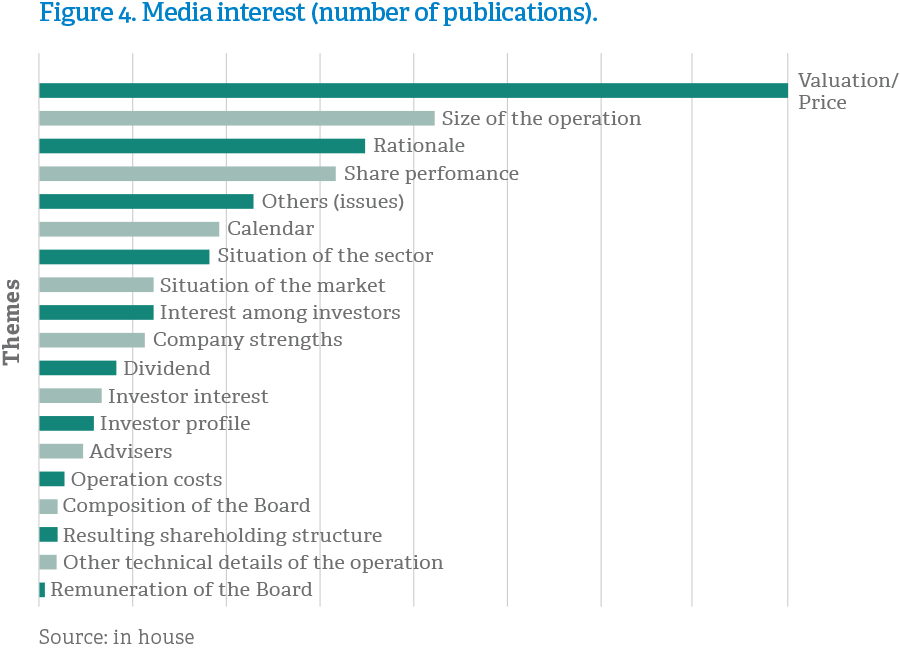

We will now consider the themes of greater interest to journalists, and therefore those which occupy the greatest number of column inches. Among the most predominant themes, we would particularly highlight two which are truly sensitive, where the management of effective communication is crucial for both the company’s reputation and the success of the exchange transaction. Those themes are the valuation or the initial price which journalists ‘sense’ the shares should have, and the reason why the company has decided to proceed with an IPO, its rationale, beyond that of securing funds.

The cause-effect consideration is important: the price imposed on the stock by the market is only known when the entity has already run, at least, twelve miles of the marathon which an IPO represents. But, from the very first steps, the press speculates and conjectures about the value of a company, based mainly on the opinions of third parties. Thus, it is clear that the company’s communication efforts must begin sufficiently in advance.

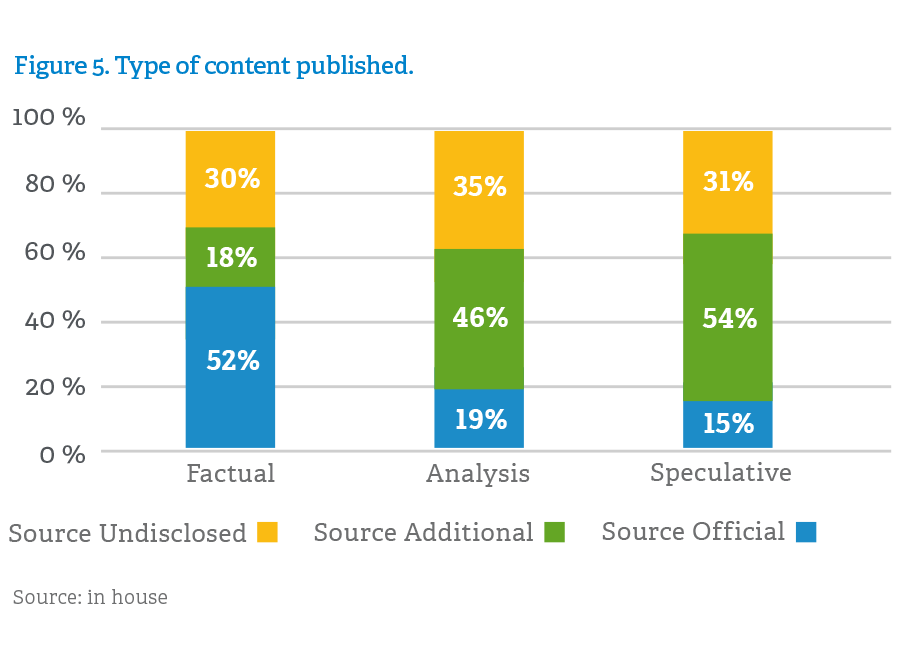

Obviously, official sources predominate in informative contents, while the analytical or openly speculative tone normally come from unofficial sources in some way knowledgeable about the operation or simply from undisclosed sources.

Our content analysis reveals that those operations in which the companies made a greater communication effort show more reporting of a simply factual nature. In other words, proactivity generates news based on official sources, while silence does not mean that the issue is ignored, it simply leads to the increased use of other sources.

During an IPO, there are many interested sources: bank advisers, (chosen or ruled out), law firms, investors and company executives with specific interests, etc. Each one of them wants to influence the process. Journalists regularly interact with all those interested sources, it is part of their work, but their use is accentuated when the company’s official version does not meet the information needs or expectations of the media outlet. It will then turn to “knowledgeable sources”, “market sources”, or “sources close to the operation”, which any reasonably aware reader can easily guess where they come from, as is also suggested in the next section. This phenomenon was constant in the IPOs in the first half of 2017. Even in articles whose tone was largely informative, undisclosed sources are mentioned (see graph).

DOES THIS ANALYSIS ANSWER ANOTHER OF OUR INITIAL QUESTIONS: “IS IT POSSIBLE TO AVOID MEDIA SPECULATION OR RUMORS ABOUT THE IPO”?

In our opinion, they can at least be reduced, as the lack of information from the company increases the use of other sources which can only be reported in the form of rumors or speculation.

11 PIECES OF ADVICE FROM JOURNALISTS ON IPOS

When is it advisable to speak to journalists in an IPO? Many companies still reply with a resounding ‘never’. In practice that ‘never’ inevitably means ‘when the first problem arises’.

In order to avoid that all-too-frequent mistake, we carried out a series of interviews with journalists from the leading economic and general dailies, both in print and digital. They acknowledge that an IPO is the best publicity campaign for any company, but, at the same time, they warn that they will continue to do everything they can to provide their readers with relevant information, whether it comes directly from the company or not.

We will now list and classify the main warnings and pieces of advice from the media to communications and public relations managers of any company embarking on an IPO.

COMMUNICATION WITH THE MEDIA: FUNDAMENTAL IN AN IPO

If you are going to hire a media agency to manage communications in regard of the IPO, ask them to start working at least three months before the announcement of intentions. In that way, it will have more time to build up the brand, while at the same time identifying the key journalists and establishing adequate relationships of trust with them.

THE IMPORTANCE OF A COMPANY’S TRACK RECORD

In this prior phase prepare a track record of the company and have your investor relations manager present it to the journalists you consider key, individually and sufficiently in advance. In this way, when the IPO begins, they will know your company better and will find it easier to trust you. Repeating that practice during the aftermarket can also be a good strategy.

EQUITABLE COMMUNICATION WITH THE MEDIA

During the three or four weeks of the process, the prospectus, the coverage of the order book, the price range and the debut are the milestones of greatest media interest. Inform the press about them in an fair manner. The temptation to give information exclusively to one publication does not usually pay off in the long term. Journalists always recognize and applaud equal treatment.

WITH THE FEET ON THE GROUND

Be especially cautious with the price range and the degree of coverage. Too many companies have peaked too early and they ended up paying for it, which removes credibility in shareholders’ minds. Do not mislead with regard to the demand and be realistic about the range of bid, those are golden rules.

THE IMPORTANCE OF A REALISTIC BULLETIN

The prospectus has become a detailed – almost hyperrealist – portrait. It examines, under the microscope, even the most imponderable risks or the remunerations policy. For journalists, it represents the culmination in terms of information. Given that expectation, it is essential to take great care with the drafting and wording of the document: do not be on the defensive, tell a good story, explain the strengths and weaknesses with conviction. A good prospectus always adds luster to an IPO. It is surprising that, even today, prospectuses are distributed without the communication departments or agencies knowing their content sufficiently in advance. If, in addition, it is released at a reasonable time, the journalists will thank you for it and will be able to do their work better.

NECESSARY ANNOUNCEMENTS TO THE MEDIA

The requirements of the prospectus have become so exhaustive that they are obliged to include risks in many areas or ones which are simply implausible. Out of sheer morbid curiosity, journalists tend to focus on these aspects and magnify them. Decide whether it is worth contextualizing them and clarifying them yourself, rather than allowing them to be amplified or rendered even more far-fetched.

ACTING AS AN EXCLUSIVE AND A PROACTIVE SPOKESPERSON

If, during the IPO, you only inform about relevant events, others (including your competitors) will fill in the gaps. It is possible that advisers could recommend you to remain silent, to then take advantage of your information blackout to push their own interests and points of view, and that is of absolutely no use to you whatsoever. Consider whether you should act as the exclusive, proactive spokesperson, rather than signing an ambiguous commitment to silence with the various parties, which, in practice, all too often is not worth the paper it is written on.

MEETINGS OFF THE RECORD

All the journalists we consulted appreciate and respect the possibility of holding off-the-record meetings with the company in the course of the process. They are useful to them, to refine details, gauge possible leaks from advisers or competitors, and to produce more accurate news articles. Establish fair ground rules, communicate them to everyone in advance and then apply them rigorously.

RELIABLE MARKET SOURCES

Market sources, those which are well-informed, those close to the operation, or whatever they are called: these have, inevitably, become clichés. Plan how, when and why to use them, and then apply your decision with impartiality. Those in the media also appreciate you giving them clues, because those indications make their work a lot easier. Journalists always know what they are writing about and who they trust.

TRANSPARENCY AS A TOOL

The arrival of large investment funds and new international actors is changing the relationship with the media. They are more direct and sometimes they even dive right in, confidently and resolutely. The strategy usually works. Consider whether being more proactive is a better strategy than simply repeating ‘no comment’ time and time again. Journalists tell us that when you are open and proactive it is more difficult for them to criticize you.

THE AFTER MARKET IS NOT BY FAR THE FINAL POINT

The aftermarket is not the end. At the very most, it marks the end of a particular stage, which will be followed by an endless number of relevant events, announcements of projects, corporate plans, etc. So, if a public company turns its back on the press or on investors, it will eventually become irrelevant. If a company believes it does not benefit from appearing in the media, it is likely that, sooner rather than later, it will find itself in a media meltdown.

CONCLUSION

To sum up, all too frequently the press does not see a company’s management team even once from the declaration of intentions until the aftermarket has been concluded. That is why journalists consider it a lost opportunity, and they are very probably right. In any case, remember: if, when the occasion arises, you do not do it well, you are helping to make the final effect negative. So, plan, compare and decide each step together with your agency.