Latin America: a region in constant transformation

Although way below the performance of the Asian economies, the Gross Domestic Product (GDP) growth expectation of over 2% in Latin America forecast for the next two years reflects a sustained economic recovery in the region, largely underpinned by domestic consumption. In this scenario, the trust relationship between consumers and businesses is a cornerstone for development in the region.

This study explores this relationship and its challenges based on almost 4,000 surveys in nine markets (Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Panama, Peru and Dominican Republic) and six key sectors: Food & Drink, Automotive, Pharmaceutical, Financial Services, Retail and Telecommunications.

The new Latin American consumer

The strength of private consumption in Latin America is one of the many indicators that reflect a number of changes, especially:

- Growth of urban population: it is calculated that 85% of the Latin American population will live in urban areas by 2030, increasing the demand for housing, infrastructure and services.

- The number of single-person households is rising to unprecedented levels in Latin America.

- Older consumers: consumers aged over 65 currently represent 7% of the Latin American market. This figure is expected to reach 15% by 2020 (83 million).

- The income of Latin American households is increasing, mostly as a result of the larger number of women in the labor market. Their participation is expected to grow by 20 million up to 2030.

Just as in other parts of the world, these socio-demographic movements accompany global trends that have given consumers more power in their relations with business, such as:

- Increased connectivity. More than 61% of the population in the region is now connected to the internet. Although there is still work to be done in this respect, progress has clearly been made. And this greater access drives the new Latin American consumer.

- E-commerce. In the wake of this increased connectivity, e-commerce is expected to grow by 16% over the coming years. Apart from the figures, this trend shows that consumers are more active and proactive in their relations with businesses and brands.

- Inevitably, the increased connectivity and boom of social networks have converted the relationship between brands and consumers into a glass box, which requires a more direct, transparent approach. The challenge of meeting expectations in an era of Fake News is not to be infallible, but to be honest when one makes a mistake.

Against this backdrop, consumer-business trust also blends with exercises of citizenship that are very important for both parties, especially for businesses, which must boost this trust relationship as the driving force for growth.

The keys to trust in the region

The main conclusions drawn from analyzing the perception of trust in six economic sectors, polling almost 4,000 consumers in nine Latin American markets are:

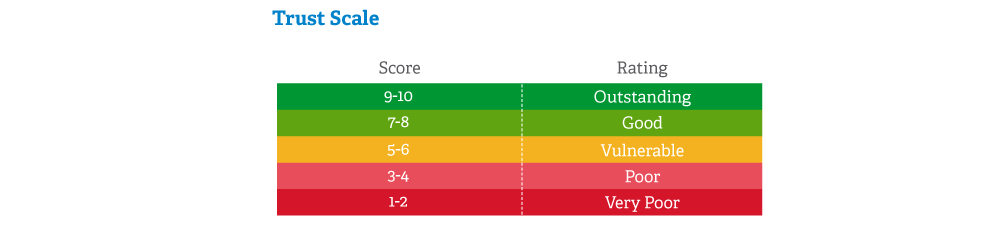

Although there is generally a good climate of trust in companies, no sector has an outstanding rating on the trust scale

- No sector in the region enjoys exceedingly strong trust.

- However, on average, Latin American consumers trust their companies more than Spanish consumers, for example.

Consumers are more trusting in the North of the region than in the South

- Mexico, Panama and the Dominican Republic had higher trust levels.

- Chile, Argentina and Peru had the lowest trust levels.

Food & drink is the sector with the highest trust rating in Latin America

- The pharmaceutical sector ranked second in terms of trust.

The financial and telecommunications sectors received the lowest trust ratings in the region

- Data management, transparency and ethical issues weighted heavily in the perception of those polled.

Automotive and retail have above-average trust in the region

- The key factors of these sectors for Latin American consumers are product guarantees and information.

Credibility, which derives from product/service, and integrity in business practice are key dimensions for consumer trust

- Transparency is important but ranks below the other two in priority.